When autocomplete results are available use up and down arrows to review and enter to select.

Community banks provide a menu of payment services ranging from credit, debit, and prepaid cards to support their customers’ payment needs. The Federal Reserve’s triennial survey highlights shifts in consumer payment behavior. The study finds cards continue to increase their share of non-cash payments.

Credit card payments saw robust growth at an annual rate of 9.9 percent by number. A notable trend is the rise of debit cards year over year, which were used almost twice as often as credit cards. However, the value of credit card payments exceeded the value of debit card payments by nearly 30 percent.

Crucially, in the post-COVID-19 environment, the debit card, which is linked to a bank account, has become a powerful financial management tool for consumers in the weakened economy.

Source: The 2019 Federal Reserve Payments Study

The coronavirus era accelerated existing trends with the shift toward digital channels and digital payment methods. Reflecting the increasingly digital world, mobile wallets, transactions from e-commerce activities, peer-to-peer (P2P) money transfers from apps (like PayPal, Venmo, Zelle, and Square Cash), and the gig economy are fueling card payments.

Online, the number of consumers who make half or more of their monthly purchases via e-commerce flourished during the pandemic. Economic indicators collected by the U.S. Department of Commerce estimate e-commerce transactions increased 32.1 percent in the fourth quarter of 2020 from the fourth quarter of 2019. This trend is expected to continue.

With the increase in digital payments, fraud is also on the rise as bad actors take advantage of the disruption from the crisis. The dollar volume of attempted fraudulent credit and debit charges soared 35 percent from the previous year. However, community banks are incorporating technology enhancements, such as tokenization and 3D Secure, to improve traditional payment cards' security.

Meanwhile, in the wake of the public health crisis, at the point-of-sale, perceptions of safety and touch-free convenience catalyzed a preference for contactless technology. Indeed, more than half (51 percent) of Americans now use some form of contactless payment, which includes tap-and-pay cards and mobile wallets like Apple Pay and Google Pay. Younger consumers are the most motivated to switch, with 72 percent of Millennials, compared to 56 percent of Generation X consumers and 31 percent of Baby Boomers, using contactless payments. More significantly, the market growth in remote transactions enabled by touchless technology is anticipated to continue in the coming years.

Looking ahead, evolving consumer behavior will drive two trends in the card industry: rewards and mobile payment technology. Recognizing the increased mobile wallet usage, community banks are expanding their digital capabilities with card features like cardholder controls and rewards ranging from cashback benefits to emerging perks like Bitcoin. Acquiring these digital capabilities is essential for financial institutions to maintain customer stickiness. Importantly, the key to remaining “top of wallet” will be incentive offers in combination with customer engagement to build loyalty.

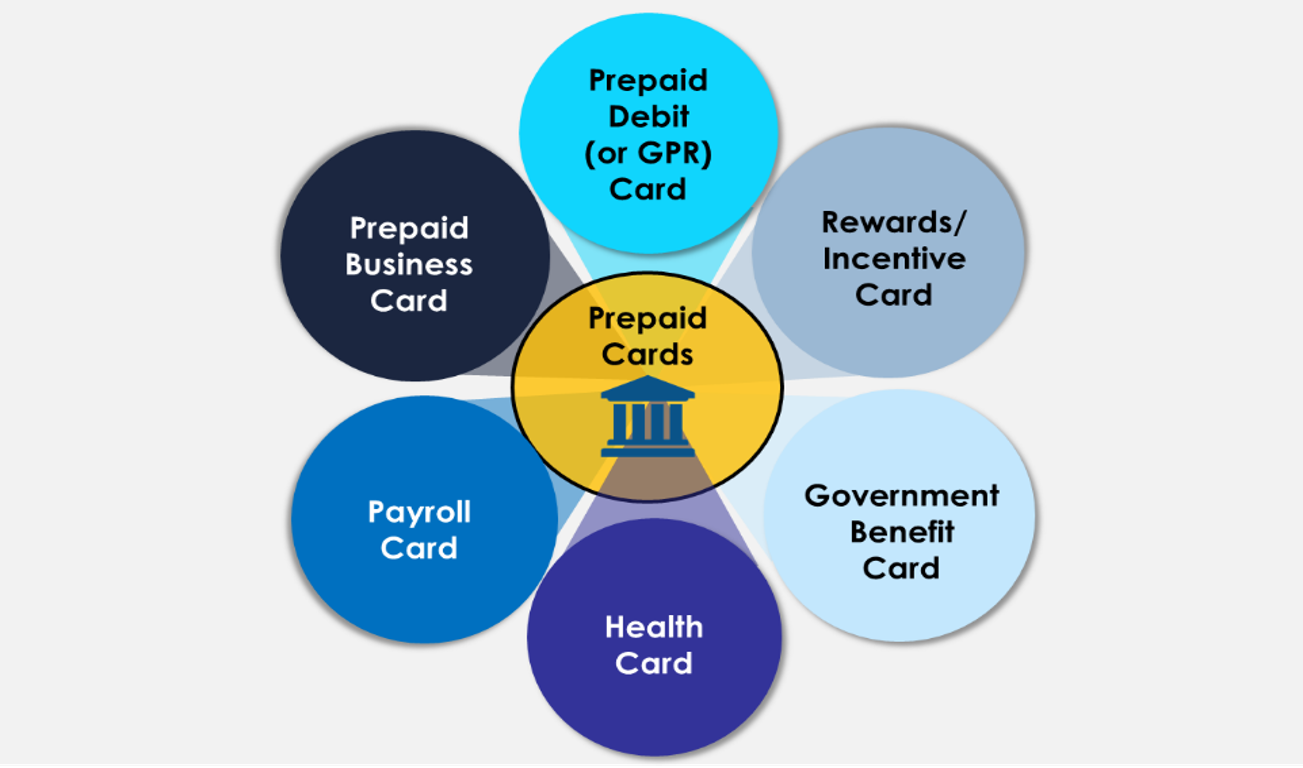

Another type of card experiencing growth in the post-COVID environment is the general-purpose reloadable (GPR) prepaid card, or prepaid debit card. Community banks offer a suite of prepaid card products that range from general use, government programs to payroll, rewards/incentives, and health benefits. However, the largest opportunity lies with prepaid debit cards that offer an accessible banking option to reach the underserved community like the unbanked or underbanked segments, including Millennials.

The first round of stimulus payments were sent to approximately 4 million consumers. Another 8 million Americans are anticipated to receive Economic Impact Payments on a prepaid debit card in the second round of stimulus payment. These are consumers who don’t have banking information on file with the IRS and may be largely underbanked.

According to a 2019 FDIC survey, 27.7 percent of unbanked households used a prepaid card, compared with 7.4 percent of banked households.

ICBA firmly rejects any attempts by the government to interfere with the pricing of payment card interchange fees or other financial service charges. Such government intervention undermines the crucial principle of free market competition, hindering both issuers and consumers from selecting the payment card options that best meet their needs.

ICBA strongly supports the continued viability of payment card systems that recognize the important role of community banks as digital delivery channels evolve.

ICBA supports consumer choice in payment card offerings through enhanced transparency, education and fairness. However, ICBA opposes any efforts that would limit choices for consumers across the socio-economic spectrum or subject community banks to legal and compliance burdens.

ICBA supports efforts to improve payment card security and decrease fraud through evolving card security technologies and consumer education.

Community banks provide a menu of payment card services to execute the exchange of monetary value. They strive to balance transparency, safety, soundness, and sustainability in payment card programs that support the needs of a financially varied customer base.

The Executive branch, Congress, and the federal agencies must exercise caution to not unnecessarily impede community banks’ ability to respond expeditiously to changing markets and consumer needs. They must recognize that community bank payment card programs cannot operate at a loss. If community banks cannot offer balanced card programs, they will be forced to consider discontinuing products, further consolidating the industry, resulting in fewer choices and limited access for consumers and small businesses.

Payment card system stakeholders are concerned about mitigating security risks and the need to adopt more sophisticated and secure technologies. To mitigate the risks resulting from increasing digital transaction volumes, it is critical for all stakeholders to deploy advanced technologies optimally designed to keep pace with the evolving threat landscape.