When autocomplete results are available use up and down arrows to review and enter to select.

Find out what's happening in communities across America, from grassroots advocacy efforts, to fintech innovations and everyday successes of Main Street banks.

By Aaron Stetter

By Aaron Stetter

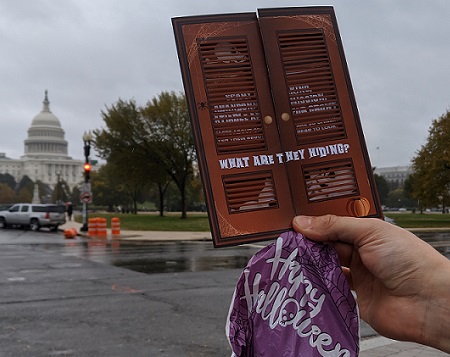

Several ICBA staffers today are handing out Halloween cards and candy to every congressional office on Capitol Hill to encourage lawmakers and staff to open their eyes to credit unions' risky practices, costly tax subsidies, and irresponsibly lax oversight. Meanwhile, ICBA offers Halloween-themed graphics that community banks can use on social media to raise awareness of this disturbing problem.

In a nod to the see-no-evil, hear-no-evil approach of the National Credit Union Administration, ICBA's card to Congress says: "Scary risk-taking, abandonment of mission, insatiable appetite for growth. The facts about credit unions are so chilling—even their regulator can't bear to look."

ICBA makes clear in its new "Do They Know They're Tax Exempt?" research paper that credit unions have strayed from their founding mission while diverting up to a third of every dollar in tax subsidy they receive to executive compensation, glitzy marketing, multi-million-dollar stadium naming rights, and other luxuries. That should spook not only the taxpayers who fund these extravagances, but the credit union members who aren't seeing those funds reinvested in their own financial well-being.

With ICBA and community bankers sounding the alarm, Washington can no longer hit the snooze button and hide from the credit union menace and their $2 billion annual tax subsidy. Let's continue pressing Congress to enhance credit union oversight and slash the subsidy that continues to haunt taxpayers, including community banks. The good news is this is a nightmare from which we can awake.

Aaron Stetter is ICBA executive vice president of policy and political operations.