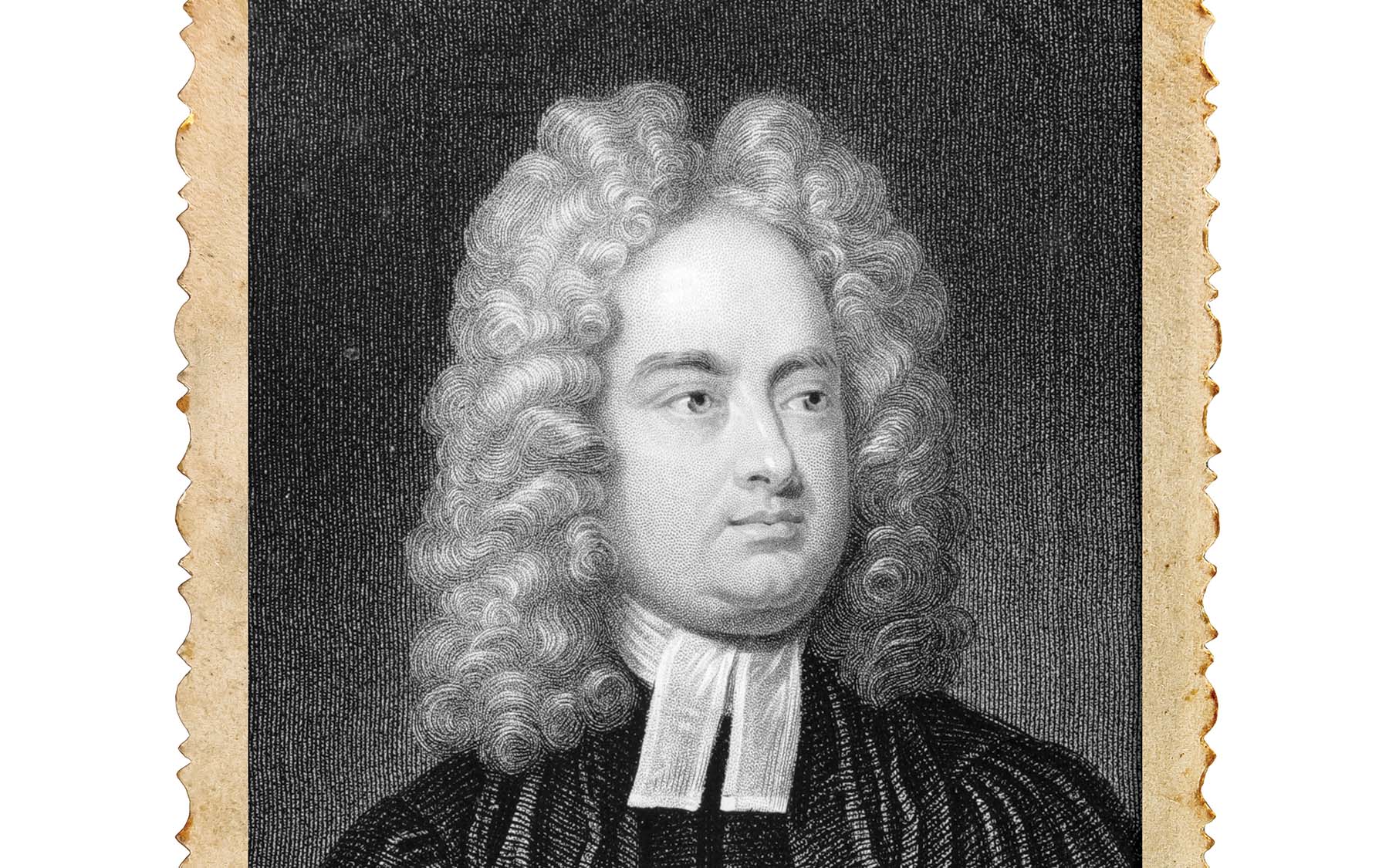

As far as learned, wise and clever writers go, one could do worse than reading the works of Jonathan Swift. Described by Wikipedia as “the greatest satirist of the Georgian era,” he was also an Anglican cleric, which explains some of the social commentary in his works, including A Modest Proposal and Gulliver’s Travels.

A closer look at his writings reveals a person who has some understanding of the financial world as well. The 18th century saw a thriving British economy, and while wealth distribution was an issue that Swift made mention of frequently, he also was witness to plenty of commerce.

Here, therefore, are some Swiftian quotes that can apply to banking and finance as we know it. (This doesn’t necessarily make me a “Swiftie,” which is another story altogether.) As Rev. Swift himself might have said had he read this column, “Fine words! I wonder where you stole them.”

“A wise man should have money in his head, but not in his heart.”

This gets right at the core of community banking. While ICBA members are known for their ability to work with borrowers that have unique stories and needs, they certainly know how to balance risk and reward by sticking to safety and soundness. The industry’s recent track record of astonishingly low past-dues is testament to that.

“It is useless to attempt to reason a man out of a thing he was never reasoned into.”

This scenario, it seems, explains why relatively few portfolio managers are willing to sell assets at a loss. I think there’s a sense of surrender, or admittance of error, when bond losses are realized and recognized. Often, there are sound economics behind a loss/earnback strategy, especially when industry earnings are otherwise solid, like right now.

“I heartily hate and detest that animal called man, although I heartily love John, Peter, Thomas, and so forth.”

A number of times in my career, I’ve heard highly successful community bankers admit they really don’t like having to run a bond portfolio. Some of these individuals owned a collection of bonds they rightfully should have been proud of. Still, between having mark-to-market accounting issues and lower returns than loans, they wished for a better alternative. But let’s look at the bright side: Unrealized losses are at a four-year low, and portfolio yields are at an eight-year high. So, my advice is to love your Johns, Peters and Thomases, otherwise known as your mortgage-backeds, CMOs and munis.

“There were many times my pants were so thin I could sit on a dime and tell if it was heads or tails.”

At some point, the good reverend must have encountered a period similar to the 2008–2010 era for depository institutions, during which the entire industry struggled. The FDIC reported 297 bank failures in 2009–2010 alone. I’m very pleased that things are going well for community banks, which are both profitable and well capitalized. It is also news to me that coins had “heads” and “tails” in the 1700s.

“If a lie be believed only for an hour, it hath done its work, and there is no further occasion for it.”

Perhaps there was a Silicon Valley Bank-esque liquidity scare in Georgian England. It was just three short years ago that the banks least exposed to uninsured deposits—chiefly, ICBA members—had to remind their customers, both commercial and retail, that very little of the deposit base was outside FDIC-insured limits. Still, there were pockets of disintermediation, and ICBA’s communications team worked overtime to explain, again, the differences in Main Street and Wall Street banking. Happily, community banks were able to calm the nerves of their depositors, and this “hour” passed relatively quickly.

“You can work it out by Fractions or by simple Rule of Three, But the way of Tweedle-dum is not the way of Tweedle-dee.”

This is a reminder that bond math is not linear, and separately, bond pricing and accounting systems rely heavily on estimates. This can produce fluctuations in some of the more critical portfolio metrics, such as effective duration, cash flow and, therefore, yield. If 2026 sees a nominal drop in market yields, and maybe a further steepening of the treasury curve, your portfolio’s performance could be affected. So, be sure to inspect these assumptions and keep those questions coming.

Which brings us to this final Swiftian gem: “We neither of us are able to deliver our conceptions in a manner intelligible to the other.” Evidently, Jonathan Swift had bank examiner-like conversations with his contemporaries.

Barret Graduate School of Banking May 17–22

ICBA’s endorsed banking school has opened registration for its 2026 session. The school is based in Memphis, Tennessee, and is exclusively community bank focused. Barret has earned the endorsement of 18 ICBA state affiliates. For more information, visit barretbanking.org